What are the Biggest Challenges For Bitcoin in 2024?

Bitcoin has been among the most volatile financial instruments in the world, but it has also demonstrated incredible growth potential. Enter the fascinating world of Bitcoin, a digital money, and go on a crazy odyssey spanning more than ten years. Imagine a world with only digital money, neither paper nor metal. Since its inception, Bitcoin has fascinated, perplexed, and occasionally even alarmed people. This unusual currency is confronting some significant difficulties in 2024. It’s like a puzzle with pieces missing; some relate to money, some to safety, and others to how people view and utilize it. Let’s explore the fascinating and occasionally perplexing world of Bitcoin to identify its key problems for 2024.

Here are the 10 biggest challenges for Bitcoin in 2024:

1. The Halving

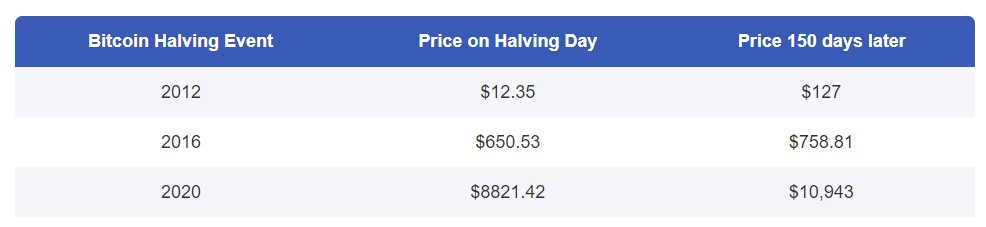

The cryptocurrency industry is no new to disruptions, and the impending halving of Bitcoin in 2024 is expected to be significant. The effects on the price of Bitcoin are more complicated because the rewards for miners are reduced every four years. The complicated dance between supply and demand becomes more prominent as miners’ earnings are subject to a significant reduction, possibly changing the dynamics of the Bitcoin market. While the past provides a glimpse of previous rallies sparked by halvings, the current environment—characterized by shifting patterns and increased investor awareness—adds a sense of unpredictability. Can the past forecast the future in light of a developing market and greater investor awareness? Previous halvings have resulted in booms.

2. Regulation

Regulating cryptocurrencies has a few drawbacks. Some countries have welcomed Bitcoin, while others are concerned about its disruptive potential. A varied group of nations will dance to the melody of regulation when the curtain rises in 2024, forming the outlines of Bitcoin’s future. The stakes are enormous, with regulatory choices driving Bitcoin toward widespread adoption or condemning it to specialized obscurity on a global scale. Bitcoin’s destiny is still constrained by a precarious balancing act between innovation and compliance while the fight for regulatory harmonization rages.

3. Environmental Concerns

Bitcoin mining uses a lot of energy, which has caused environmental issues. Some contend that Bitcoin should be outlawed because it cannot be sustained. By 2024, there will be a greater focus on how Bitcoin affects the environment, which may influence how it is mined. As environmental issues gain prominence, worries regarding the sustainability of bitcoin mining grow. Will cleaner mining techniques become more prevalent in 2024, or will the environmental debate affect the ecology?

4. Competition from other Cryptocurrencies

Bitcoin is no longer the only cryptocurrency available today. There is tremendous rivalry in a sector that has exploded to accommodate thousands of alternative cryptocurrencies. Some of these entrants promise improved functionality and efficiency while touting capabilities that Bitcoin still needs to include. The expanding number of cryptocurrencies vying for users’ attention in 2024 may pressure Bitcoin’s price and force it to demonstrate its viability in the face of ongoing innovation.

5. Public Acceptance

The rise of Bitcoin from the margins to the center of attention has been a wild trip. In 2024, more businesses are anticipated to accept Bitcoin as legitimacy progressively creaks its doors. But a crucial issue remains: Will Bitcoin move beyond its current status as a speculative mysticism and become an essential part of daily transactions? Bitcoin’s future as a revolutionary currency or an intriguing investment vehicle will depend on how quickly technology, consumer tastes, and larger economic changes coalesce.

6. Volatility

The erratic history of Bitcoin is an indisputable feature of its existence. The unpredictability of the surges and crashes has come to represent cryptocurrencies. The prognosis for 2024 indicates that this exciting volatility will continue. New and experienced investors brace themselves for irrational market swings that may characterize the year.

RELATED: Bitcoin Price Prediction 2024: Will BTC Hit $100,000?

7. Battling Cybertheft

Bitcoin’s foundation in cryptographic concepts has been guaranteed strong security for a long time. But the ever-growing universe of cyber threats has revealed chinks in its defenses. The news is constantly filled with reports of lost assets, exchange hacks, and mining failures. Bitcoin’s standing as a haven for valuables is at risk as the fight against cybercrime continues. The safeguards’ success will determine whether Bitcoin survives as a trustworthy store of value in the face of constantly changing digital dangers.

8. New Technology

The financial environment is constantly changing because cryptocurrency is a groundbreaking technology that came along ten years ago. The market is always changing due to these technologies’ fast development, making it difficult to predict what will happen to Bitcoin. At a crossroads, potential purchasers weigh their investment options while weighing the constantly changing Bitcoin market conditions.

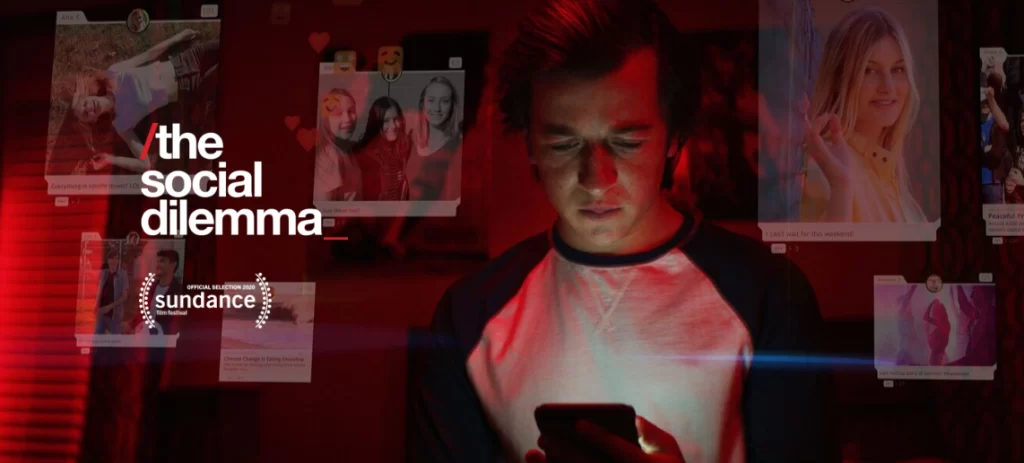

9. Reputation for Criminal Use

Due to its early connections to illicit activity on the Dark Web, Bitcoin’s promise was eclipsed. Bitcoin was the favored method for people who dealt with illegal products, including drugs and illegal weapons, as a means of money laundering and obtaining such things. Due to its special ability to conduct anonymous transactions, it unwittingly participated in undercover activities.

10. Fraud

The Bitcoin market and its popularity have also attracted a swarm of fraudsters keen on exploiting unsuspecting investors. Beyond the risk of hacking, widespread fraud has increased. Fraudsters take advantage of the absence of monitoring and regulation by creating fake exchanges and scams that entice investors to part with their money. Even reputable groups have warned against these dishonest actions, recommending caution in a setting rife with deceptive actors.

Conclusion

Despite these challenges for Bitcoin in 2024, the story is still enthralling. The effects of the imminent halving, legislative tug-of-war, energy sustainability, altcoin competition, mainstream integration, price volatility, and the struggle against cyber theft create a complicated tapestry. Even while Bitcoin supporters are upbeat, the future is still tantalizingly unclear. The evolution of Bitcoin will continue to enthrall, perplex, and change the financial environment if there is one undeniable thing. As we work through these difficulties, one thing is obvious: the Bitcoin drama still needs to be done.

MORE BLOGS: