Bitcoin Price Prediction 2024: Will BTC Hit $100,000?

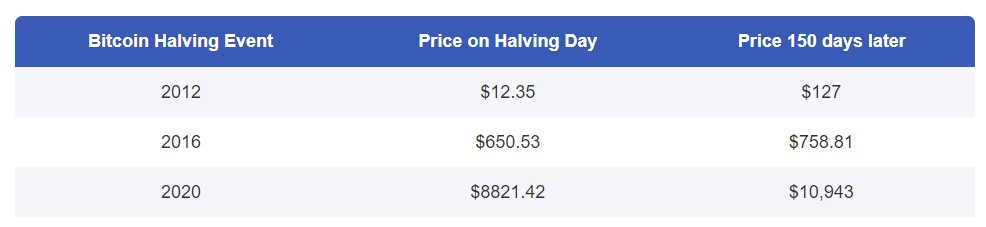

Recently, Bitcoin has taken all of us on a wild trip, skyrocketing to a startling high of about $69,000 in November 2021, only to crash back down to about $18,000 by July 2022. What is ahead for the most well-known cryptocurrency in the world as we approach 2024 after such a heart-pounding journey? Be prepared to dig into 5 elements as we attempt to direct the Bitcoin ship toward the elusive $100,000 level.

Five factors that could affect the price of Bitcoin in 2024:

1. Adoption by Institutional Investors

If there’s one thing we’ve discovered, the major players are adept at swaying the Bitcoin market. BlackRock and Fidelity announced their entry into the Bitcoin market in 2021, and the following ripple effect was substantial. The once mysterious realm of cryptocurrency gained credibility thanks to these institutional investors. Could this pattern last into 2024? It’s highly likely. Cash infusion might increase the price as more institutions grow confident in it as a viable asset class.

2. Increased Regulation

The wild-west days of Bitcoin could be coming to an end. Governments worldwide will probably start regulating as it becomes more commonplace. This may give the area a sense of respectability, so it’s not necessarily negative. However, more regulations could also mean more scrutiny and potentially dampening price effects. It’s like a tug-of-war between the desire for financial freedom and the need for control.

3. Technological Advancements

Bitcoin is a technology that is alive and well, not just a virtual currency. It also develops, just as any technology. For instance, a radical shift in how it is mined may exist. Consider a more effective algorithm that makes mining simpler and produces a large number of new Bitcoins. A rise in supply can cause the price to decline. Technology influences the story in this game of balancing.

4. Economic Conditions

The complicated dance that Bitcoin performs with the world economy. Recessions, booms, and everything in between have an impact on it. A decline in demand for speculative assets like this might result from a downturn in the economy, driving down its price. On the other hand, in uncertain times, individuals can turn to Bitcoin as a “digital gold,” a safe refuge amid turbulent financial seas.

5. Public Sentiment

Never undervalue the influence of public opinion. Bitcoin’s price may skyrocket if the general public begins to think of it as a reliable investment. It works like a self-fulfilling prophecy; it will if you believe it can happen. But if the mood deteriorates, it’s like putting a damp blanket on a fire. Public opinion is susceptible to swings and is frequently shaped by internet memes, celebrity endorsements, and news cycles.

Will Bitcoin Reach $100,000 in 2024?

We know that BTC has increased by more than 80% since the year’s beginning. With such enormous and unexpected growth, it has outperformed several other important assets and provided fantastic returns to those who purchased BTC at a discount.

The market is anticipating more and is thrilled to see the largest cryptocurrency reach a new top. Marshall Beard, the chief strategy officer at the American cryptocurrency exchange Gemini, predicts that Bitcoin will surpass all-time highs in 2018. In his words, “the $100,000 price figure is interesting if it rises to its prior record high of close to $69,000.

If it reaches this enchanted number, it must rise by 270% to reach the threshold of $1 lakh. The chief technological officer of Tether, Paolo Ardoino, is likewise rather upbeat about Bitcoin. According to him, Bitcoin might “retest” its record high of over $69,000.

However, 2024 appears to be a favourable year for proponents of Bitcoin, who always view it as a “safe-haven investment” or “digital gold,” which may provide investors with a decent hedging opportunity or an alluring return in times of mayhem.

The U.S. financial and banking environment may lessen the likelihood of the U.S. Federal Reserve raising interest rates more aggressively, which has given it a significant boost.

Now, the million-dollar question (or should we say $100,000) remains: Can Bitcoin hit that six-figure mark in 2024? The elements we’ve looked at here make it appear conceivable, even if we can’t forecast the future with total confidence.

Here are some additional thoughts about Bitcoin:

- Bitcoin is a quirky and unpredictable beast. Its price can make your head spin, and investing in it is like riding a roller coaster blindfolded. Before you jump in, do your homework. Cryptocurrency investing comes with its fair share of risks, and it’s crucial only to invest what you can afford to lose.

- And remember, the road is a long and winding one. Patience might just be your best friend in this game. That $100,000 peak could be around the corner or miles down the road. There are no guarantees, only the thrill of the ride.

- Ultimately, whether or not to dive into the world of Bitcoin is a personal call. Consider the pros and cons, weigh the potential gains against the potential losses, and remember that while $100,000 is a compelling goal, it’s just one part of the larger cryptocurrency puzzle.

Overall, it is difficult to say whether Bitcoin will hit $100,000 in 2024. However, the factors listed above suggest that it is a possibility.

MORE BLOGS